“If you really want to do something, you’ll find a way. If you don’t, you’ll find an excuse.” Jim Rohn

That quote up there is so very short, but it says it all doesn’t it? I’m as guilty as the next person when it comes to finding excuses to get out of doing things that I don’t want to do. That right there is the key though, I make the excuses for the things that I DON’T really want to do. This is going to be tough, but I am asking you to be extremely honest with yourself throughout this post. If you do that and you still decide not to pursue a particular goal, then it is really more a matter of prioritization than anything else.

Let’s explore the two areas that seem to come up time and time again in regards to people telling me they can’t achieve certain goals because of: ENTER EXCUSE HERE. Those two areas are weight/fitness and personal finances.

Weight/Fitness

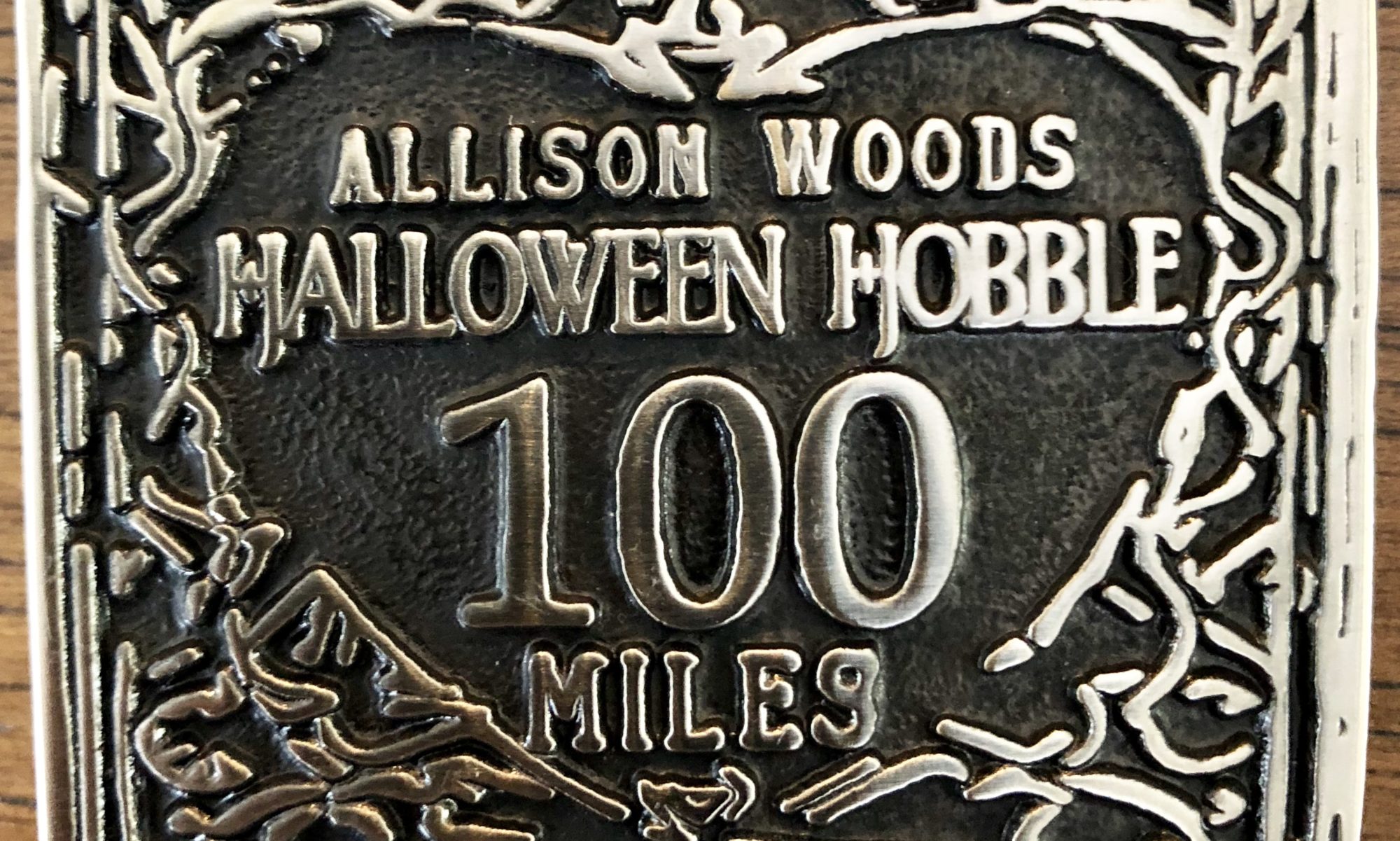

The list of excuses here goes on and on, my genetics/metabolism are terrible, I don’t have the time, it’s so difficult to eat healthy, I have a bad knee, I can’t afford it… Heard any of these? USED any of these? Yeah, me too. But they are bullshit and you and I know it. Everyone likes to point out the exception and say they “know a guy who has this issue and that applies to me.” It doesn’t. 99.5% of us are just fine and can maintain a healthy weight and body through a healthy lifestyle. In fact, I like to focus on the .5% of the people who really do have issues and say “I don’t care; I’m not going to let that be an excuse.” You see that guy in the picture up there? His name is Earl Granville and he just ran the Boston marathon and he carried his guide over the finish line… with one prosthetic leg! He lost his leg in 2008 in Afghanistan. Do you think his knee hurt?

I’m going to blow up a couple of more excuses. You don’t have time? How much TV do you watch? Are you a golfer? How much sleep do you get each day? How much time do you spend on Facebook, Instagram, or the internet in general? It takes about 30 minutes a day of exercise at an elevated heart rate to make a difference, let’s shoot for 5 times a week. That is 150 minutes in a week! You are telling me that you are so busy that you cannot find that time? I’m throwing the bullshit flag! If you woke up 30 minutes earlier and did the exercise, you’ll feel better then if you slept the 30 minutes! EVERYONE can find 150 minutes in a week. Unless of course you don’t want to. That’s not an “I am not capable” issue, that’s an “I have other priorities issue.”

By the way, those 30 minutes of exercise can be absolutely free. Running is free. Sure you need a decent pair of running shoes, but you need shoes anyway, so buy a nice looking pair and give them double duty. Walking at a brisk pace is free. Push-ups are free. (Click here if you want to see how to do 1500 push-ups a week in only 5 minute a day.) Planking is free… your picking up what I’m laying down now, right? So you have the time, don’t need the money, and are capable of doing this, NOW what’s your excuse?

Personal Finance

This is way too big of a topic to cover in a short half of a post, but I’d like to tackle the first basic principal in wealth building, and that is living within your means to create a little additional cash to save/invest each month. Here the biggest excuse I hear is simply “After we pay all of the bills, we have absolutely no money left to save/invest.” Bullshit. I’ll remind you to be brutally honest with yourself here as we ask some questions. Do you have an iPhone? What is your monthly cell phone bill? What is your car payment? How many times a month do you go to a movie? How often do you eat out? What kind of brands of clothing are you wearing? Do you have cable or satellite TV service? How often do you go out for drinks/happy hour? Do you smoke?

For 99.5% of us, after we answer those questions honestly, it should be clear that we spend a lot of money on things that we really don’t need. You need a car, but do you NEED a $35,000 car? You need a phone, but do you NEED an iPhone with unlimited calling and data? I know that you don’t NEED to smoke! Point made. There are tons of ways to save money that you can use so that you can increase or start contributing to a 401k plan or an IRA. In fact, I urge you with all of my heart to just automatically deduct 3% of your paycheck and put it in your 401k or an IRA and DO NOT TOUCH it for any reason. You won’t even notice a decrease in your take home pay after a couple of weeks and you’ll be on your way to saving money for your future! Then, with each pay raise, increase it 1%. This is a double increase because you will get the increase in savings from the raise and then the additional 1%! It adds up quick and you won’t feel it at all. STOP making excuses!

There you go. We destroyed the bullshit excuses people come up with and if you are being honest with yourself, if you do not make any changes after reading this, this is what you are really saying. “I prioritize surfing the web more than my health.” Or “I prioritize checking my Facebook page at the grocery store over saving money for my retirement.” I’m not saying that those are bad things, I am saying be honest with yourself so you make educated and honest decisions.

I hope that this post and this blog helps! If you have enjoyed the content please SUBSCRIBE!

For behind the scenes photos and comments on my training and personal life, follow me on Instagram: joe_the_runner

Questions, comments, feedback? Please leave them in the comments section BELOW and we can have a discussion!